Insurance Software Development

We build insurance software solutions that bridge the gap between businesses and their customers, enabling them to simplify policy management, claims processing, and data tracking for seamless insurance operations.

Trusted by 50+ Happy Clients & Companies

Custom Insurance Software Development

- Our software development services for the insurance industry are designed to empower your business with advanced, tailored solutions. From claims processing automation to policy management systems, we deliver innovative platforms that streamline operations, enhance customer engagement, and ensure regulatory compliance.

Leverage cutting-edge technology, including AI-driven analytics, cloud-based solutions, and robust security frameworks, to transform your insurance workflows. Our expertise ensures seamless integration, scalability, and performance, allowing you to stay ahead in a competitive market.

Partner with us to redefine efficiency and deliver exceptional value to policyholders.

Custom Policy Management Systems

Develop tailored policy management platforms to streamline policy creation, renewal, and tracking. Our solutions ensure efficient workflows, enhanced accuracy, and improved customer satisfaction while adhering to regulatory standards.

Claims Processing Automation

Implement automated claims processing systems that reduce manual effort, improve accuracy, and speed up claim settlements. Utilize AI and data analytics to detect fraud and optimize claims workflows.

Customer Engagement Platforms

Data Analytics and Risk Management Tools

The Value We Promise to Deliver in Insurance Solutions Development

Insurance Policy Management

Our solution simplifies policy administration, from creation and renewal to claims processing, ensuring efficiency and accuracy. Designed to enhance productivity and customer satisfaction, our software provides real-time updates, centralized data management, and robust reporting tools.

Headless Insurance

Headless insurance offers flexibility by separating the front-end experience from back-end systems. This allows seamless integration, better customization, and enhanced accessibility, ensuring a tailored and efficient service for all your insurance needs.

Cloud Insurance Solutions

Cloud Insurance Solutions Our cloud-based insurance solutions offer flexibility, scalability, and security, enabling seamless access to policies, claims, and customer data from anywhere.

Insurance Software Development Options

| Types of Insurence Software | Insurence Software with Basic Features | Insurence Application with Minimum Required Features | Feature Rich Insurence Application |

| Design | Simple UI | Interactive IJI | Rich Ul |

| Features | Basic | Minimum Required | Feature Rich |

| Number of Pages | Few | Less than 50 | More than 50 |

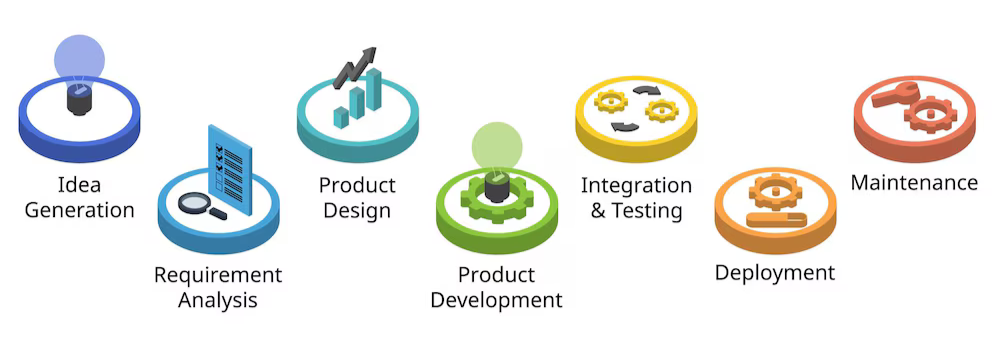

Insurance Industry Software Development Process

Flexible Hiring Model for Insurance

Software Development

Hourly Based

- Pay-as-you-go

- On-demand flexibility

- Billing transparency

Fixed-Cost

- Well-defined scope

- Project timeline

Dedicated Team

- Exclusive project focus

- Customized expertise

- Resource adaptability

Time & Material

- Versatile model

- Pay for actual work

- Flexibility in changes

Insurance Industry Process

- Risk Identification: Understand potential risks to individuals or businesses.

- Risk Assessment: Evaluate the severity and impact of these risks.

- Product Design: Create tailored insurance solutions based on assessed risks.

- Customer Engagement: Educate clients on coverage options and ensure informed decisions.

- Claims Processing: Handle claims efficiently to provide timely compensation.

Read our

reviews on:

We Ensure Seamless Collaboration

Signing the NDA

Signing the NDA is a formal agreement to keep shared information confidential.

Technical Lead Call

A call with a technical lead involves discussing technical details, or project updates.

Team Interview

An interview with the team is a session to assess a skills through team interaction.

Kickoff

A kickoff is the initial meeting to launch a project, outlining goals, roles, and timelines.

Insurance Industry service

The Insurance Industry provides essential services like risk assessment, customized policies, and claims support to ensure clients are well-protected.

Insurance Industry offers a variety of services to ensure financial security and peace of mind for its clients. These services include risk assessment, where professionals evaluate potential risks to determine appropriate coverage. The industry also provides customized policies tailored to individual or business needs, ensuring that each client has the right protection. Claims support is another critical service, guiding policyholders through the claims process for prompt and fair resolution. Customer education is offered to help clients fully understand their coverage options and make informed decisions. Additionally, the industry provides policy management services, assisting clients with updates and adjustments to their policies as circumstances change. Fraud prevention measures are also in place to safeguard the integrity of the system and protect clients. All these services work together to ensure comprehensive and reliable insurance solutions.

Testimonials

What Our Clients Say

We place a huge value on strong relationships. Our clients have faith in us. We always keep them ahead of their competitors by serving them top notch IT solutions.

Insurance Industry Detail's

Frequently asked questions (FAQ)

See the answers to some of our most commonly asked questions below.

What is a custom Insurance software development?

Every business has a different user base and each user base has distinct requirements. Therefore, the “one size fits all” approach doesn’t work here. Custom software development for Fintech helps us create personalized solutions that suit your business needs. We can tweak the features and UI of any software based on the kind of Fintech solution you want to make.

How much does it cost to build a Insurance app?

We take into account several factors for estimating the final cost of your fintech solution:

- Complexities in features & functionalities

- Complexity of third-party platform integrations

- Size of the project

- Choice of app platform

It costs you less if you need software with basic features, but if you need advanced software, it will cost you more. Although the cost to develop fintech software could be $30,000-$100,000.

How long does it take building a Insurance app or software?

The time to develop a fintech software depends on the complexities of features & third party integration you want to implement. We ensure that speed of fintech software development is attained without losing the quality and value of the product. An average software development project requires between one and nine months to complete, averaging about 4.5 months.

Which services do you offer in online payment solutions?

We offer the following services in online payment platforms–

- Embedded Finance BNPL (Buy Now Pay Later): In this, a non-finance business incorporates a Fintech service into its app or website. For example, Amazon.

- Payment Gateway: A digital payments gateway authorizes and manages payment for online retailers. They offer a smooth and hassle-free payment experience to the customers.

Along with Cross Border Payment Gateway with features like Multi-Lingual, Multi-Currency, Multi-Jurisdictional, multi account opening facilities and more. You can contact our Fintech developers for a more comprehensive discussion on this.

What is the difference between a payment wallet and a payment app?

You can use a digital wallet to store your debit cards and credit cards. Apart from that, you can also hold some cash in that wallet for instant payments. A digital app is much more broader in terms of features and functionalities. In fact, a digital wallet is a part of a digital app. With digital wallet app development, you can easily make these kinds of apps.

How do you ensure that your trading software is secure?

Our Fintech software developers implement strong encryption methods, conduct regular security audits, and stay up-to-date with the latest security threats and vulnerabilities. We are committed to offering you solutions that will resonate with your audience with robust security measures that will gain their trust.

Awards

As the world's leading web & mobile app development company, we have been privileged to win 13+ awards for our working process. We're honored to be a recipient of each of these awards for our hard work & customer loyalty.